The Best Trading Systems WIth High Accuracy & Win Rates - UPDATED 2023Last Updated: March 29, 2025 Contents Known by different names like algorithmic trading, expert advisors, mechanical trading systems and system trading, automated trading works by enabling day traders to enter specific rules for carrying out trade entries and exits. The automated day trading software is programmed to execute all the trades automatically so that the user can sit back and relax while watching the profits rolling in. As recorded in 2023, more than 75% of the stock shares traded on the U.S. exchanges originate out of automated trading systems. Reputed global brokers like CityIndex, Forex and eToro support automated trading capabilities through various platforms to take away the emotion factor from trading. In this article, we look at the advantages and disadvantages of Automated Trading and consider some of the best Algorithmic Trading Systems that deliver high accuracy trade alerts and signals. Advantages of Automated Trading Systems

Disadvantages of Automated Trading Systems

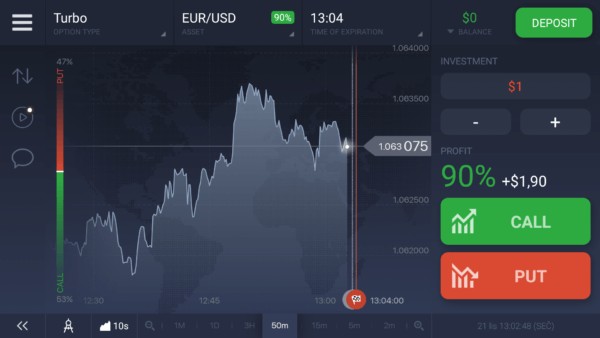

Best Automated Trading Software When it comes to automated trading systems, there is no one size fits all. The best software depends on your requirements, the market you apply it to and the level of customization you want to do. Most are geared towards automatic trading in your account - as in automatic order execution - whereas others are more geared towards giving you advice on which trades to place. Here are some of the most popular automated systems available: TradeStation A highly popular online trading platform and broker service, TradeStation provides automated trading services including trade analysis and execution and electronic order to facilitate easy design, optimization, monitoring, testing and automation of trades in ETFs, options, forex, equities and futures. Like other online brokers, TradeStation offers a wide range of account types. Features like charting and screening are impressive. The most unique thing about this platform is the analytics like best-testing abilities and walk-forward optimizer. Price of this software is better as compared to other providers. Etna Operating globally for more than ten years, Etna excels at creating custom trading software for a variety of assets. The trading platform offers high-performance strategies and allows using algorithmic trading conveniently with its user-friendly interface. It features powerful connectivity with various execution venues and integration with numerous market data feeds. It offers status alerts via SMS and email. eSignal This is another award-winning automated trading software featuring custom technology to cater the users. The online trading platform offers a variety of handy tools like streaming stock quotes, charting tools and brokers access. The software allows creating customized trading strategies and provides a large number of technical analysis indicators and drawing tools for better trading. This software is comparatively costly and hence not ideal for those who are new in the field. Option Robot An automated trading system and binary robot in one, Option Robot is designed to get you the most out of automated options trading with lesser effort. Though new in the market, the software is gaining popularity throughout the world. It offers interesting features like automated stock trading and has integration with the leading brokers. They provide a choice from three trading systems to suit traders with different levels of experience. The software is free to use. Trade Alert For us, trade alert is probably the best trading software we use. It literally scans the entire Canadian and US market and alerts us to different trade setups that are occuring in real-time. One of the nice things is that you can totally customize the softwar to be on the lookout for a certain strategy or setup that fits your particular trading style. You can get more details on their website here, or you can read our review on it here. Best Algorithm Trading Strategies The most advanced form of trading in this modern world is Algorithm Trading. The trades in this type of trading are executed by computer systems but the strategies still need to be generated by traders. Thus strategies play a vital role in determining the profits and efficiency obtained from automated trading. Let us look at some of the most popular strategies used by traders as a part of algorithm trading. Connors’ 2-Period RSI A mean reversion strategy developed by Larry Connors, the 2-period RSI works by providing a short-term buy-sell signal. This strategy gives a possible buy signal whenever the 2-Period RSI goes below 10. A move above 90 similarly generates a sell signal. To use this strategy with automated trading systems, you can first identify the long-term trend by using the long-term moving average. Traders can look for buying opportunities when the stock is above 200 DMA. RSI signal helps identify the buying and selling opportunities within the trend. The more short-term oversold or overbought the RSI, higher are the subsequent returns. The final step is using the actual buy and sell signal to execute the trade. Arbitrage Strategy A price difference in the securities of various stock exchanges can result in arbitrage opportunities. This strategy works by using these opportunities with the help of computers. If a stock is listed at a lower price on an exchange and at higher on another, the algorithm identifies it instantly and executes a trade to buy it on the low price and sell on the higher. The speed and accuracy of automated trading come into play here. The volumes of such trades if kept high can gain you notable amounts of profit. Momentum and Trend Based Strategy The simplest and the most popular, these automated trading strategies follow the momentum and trend in the market to execute the trades. Technical indicators like price level momentum and moving averages are analyzed and accordingly, the buy and sell orders are generated by the system whenever a specific set of conditions are met. This strategy also takes into consideration the current and historical price data to predict if the trend is likely to continue. Weighted Average Price Strategy This is another efficient automated trading strategy which can be based on time-weighted average price or volume-weighted average price. The orders in this strategy are large but not released at once. They are released gradually using historical data or pre-defined time slots. The strategy works by executing the order as close as possible to the weighted average price to reduce the market impact. Computerized systems release the orders in small parts to make this strategy successful. Final Thoughts With any automated trading software, the best one will be the one that best suits and fits your particular trading style. Most of the trading software listed above (other than Trade Alert) is geared towards automatically entering trades for your account, whereas Trade Alert is geared more towards automatically helping you figure out which individual stocks to trade and when. If you're trying to figure out a strategy and are leaning towards day trading, you should read our article on the Top 5 - Best Day Trading Books That Actually Work – 2023. |